04 Jun The Disposition of Your Cash Position

Automated bank feeds into your financial management system simplify bank reconciliations. This offers continuous visibility of your cash position. To maximize your cash potential, you need to track cash balances, spot exceptions, manage bank errors, and spot fraud. In this guide, we discuss the value of a financial management system that securely connects to all banks. You should always know the disposition of your cash position.

You can no longer afford to wait until month-end close to get cash insights. It should be a daily practice. Not only do you reduce the pain of monthly bank recons, but also reduces the hassle of manually matching transactions.

Table Of Contents

Streamline Your Payment Workflow

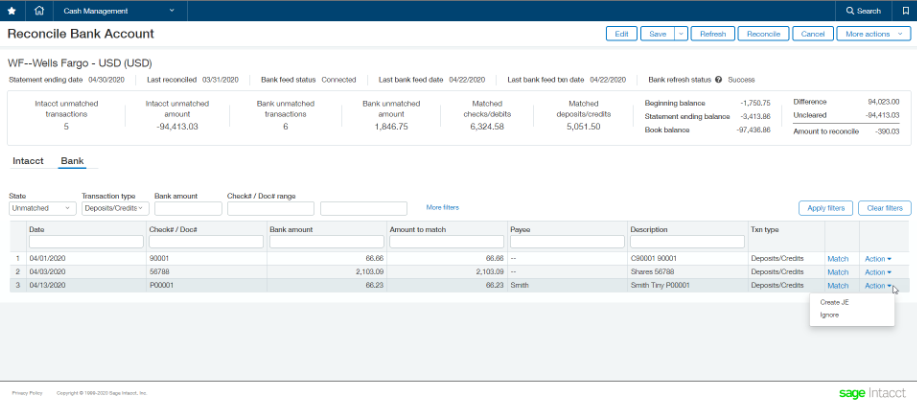

Manually matching transactions in your cashbook with your bank statement can be tedious and prone to errors. Choose a solution that offers auto-matching and also allows you to apply payments from your bank feed directly to a customer invoice.

Streamline Credit Card Transaction Processes

Tired of waiting for bank statements? With a solution that offers credit card feeds, you can create missing credit card transactions directly from your transaction feed.

Managing your transactions from a central system is key to maintaining a complete picture of your cash position. By proactively monitoring credit availability, you stay on top of your remaining credit available credit allowing you to accurately determine any outstanding liability.

Simplify Customer Payment Processes

Process your customer payments in seconds by automatically matching customer payments to invoices directly from bank transactions. Avoid failed payments with visibility into your actual cash position.

With automated bank feeds from a best-of-breed cloud financial management solution such as Sage Intacct, you gain daily cash insights and save valuable time.

Fun Facts about Sage Intacct Bank Feeds:

• Connect to over 10,000 banks and credit cards worldwide. Link to cheque, savings, and credit card accounts with the flip of a switch. Populate data in journal entries or credit card transactions from line-level transactions to save time.

• Cut hours from your close. Reconcile daily to ensure GL cash and credit card accounts are tied to bank accounts and speed up your month-end.

• Effortlessly reopen prior periods. Reopen multiple period reconciliations with a single click. No digging through multiple periods one transaction at a time.

Drop us a line on 011 792 9521 and we’d be glad to guide you in selecting a financial management solution that caters to your unique business requirements and ensures that you always know the disposition of your cash position.